What Documents Are Required to Apply for Professional Indemnity Insurance as a Doctor?

Many doctors delay professional indemnity insurance because they assume the paperwork will be complicated, time-consuming, or filled with legal fine print. In reality, the documentation required for professional indemnity is basic, logical, and very similar to what doctors already maintain in their professional lives. With the proper guidance, the process becomes straightforward and reassuring rather than stressful.

At Apex Risk Management & Professional Indemnity Services, we work closely with doctors across India and see this concern every day. The good news is that professional indemnity for doctors is not about excessive forms. It is about clarity, accuracy, and ensuring you are properly protected.

Why Documentation Matters in Professional Indemnity

Insurers request documents for three simple reasons. First, to understand your medical background and scope of practice so that risk can be assessed fairly. Second, to customize professional indemnity insurance based on your specialty, experience, and practice setting. Third, to ensure smoother claim handling if a medico-legal issue ever arises.

Well-documented policies reduce delays during claims. When details are clear from the start, insurers can respond faster and more effectively. In this sense, documentation is not just about policy approval. It is about future peace of mind.

Documents Required for Professional Indemnity Insurance

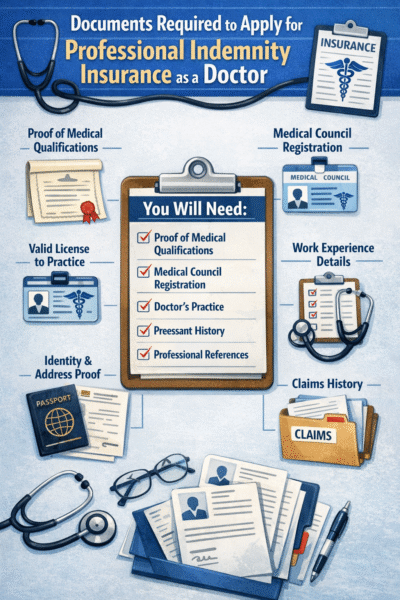

The process usually begins with your medical registration certificate. This could be from your State Medical Council or the National Medical Commission. It confirms that you are legally authorised to practice medicine and is the foundation of any professional indemnity insurance for doctors.

Next are your educational qualifications. Degrees such as MBBS, MD, MS, DNB, or specialty certificates help insurers understand your training and area of expertise. This ensures that your professional indemnity reflects the work you actually perform.

A government-issued identity document, such as a PAN or Aadhaar, is required for verification and policy issuance. This is a standard compliance step and does not add complexity.

Practice details are another key area. This includes the name and address of your clinic or hospital, whether you practice independently or in a group, and your primary specialty. These details help insurers align coverage with your real-world practice environment.

Your experience details matter too. Insurers may ask how many years you have been practicing, along with the types of procedures or treatments you commonly perform. This is not about judgment. It helps ensure that your professional indemnity for doctors is adequate and appropriate.

Claim history, if any, must be disclosed honestly. Even if a previous case was closed or resolved, transparency helps prevent complications later. Non-disclosure can create problems during a claim.

Some insurers may also ask about your consent formats or standard documentation practices, especially for procedural or surgical specialties. This reflects good clinical governance and supports smoother claim assessment.

Common Mistakes Doctors Make

One common mistake is submitting outdated or incomplete registration certificates. Another is not disclosing past medico-legal cases, assuming they are irrelevant. Some doctors underreport their scope of practice, leading to coverage gaps. Others think that hospital or group cover is enough, without realising its limitations.

These are understandable errors, especially for early-career professionals, and they are easily avoidable with guidance.

How Apex Simplifies the Process

Apex does not treat documentation as a box-ticking exercise. We review documents with you, explain what is required and why, and guide you on accurate disclosures. We help match professional indemnity insurance to your specialty, experience, and practice model.

Our focus is to ensure there are no documentation gaps that could cause issues later. This handholding approach reflects our experience in medico-legal risk and our doctor-centric philosophy.

Conclusion

Documentation for professional indemnity insurance is a one-time effort that supports years of confident practice. It is a practical step toward responsible medicine, not an administrative burden.

With the proper guidance, getting protected is simpler than most doctors expect.

FAQs

Doctors typically need their medical registration certificate, educational qualifications, government-issued ID, practice details, experience information, and any past claim history.

Yes. All past medico-legal cases, even if resolved or closed, must be disclosed. Transparency helps avoid claim rejection or policy issues later.

No. The documentation is straightforward and includes records doctors already maintain. With expert guidance, the process is quick and stress-free.